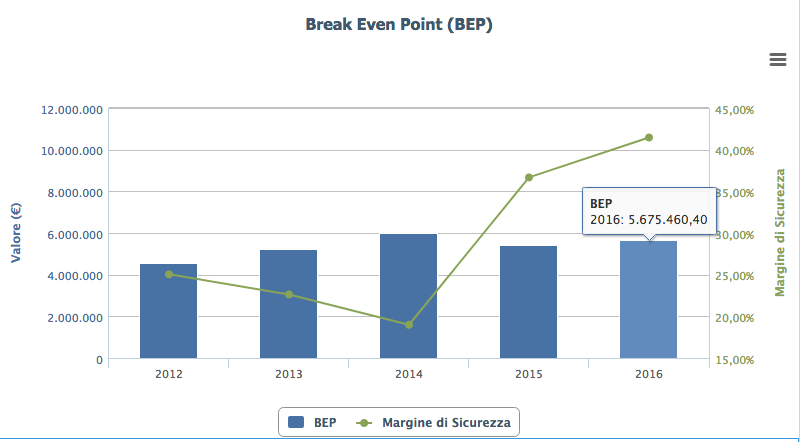

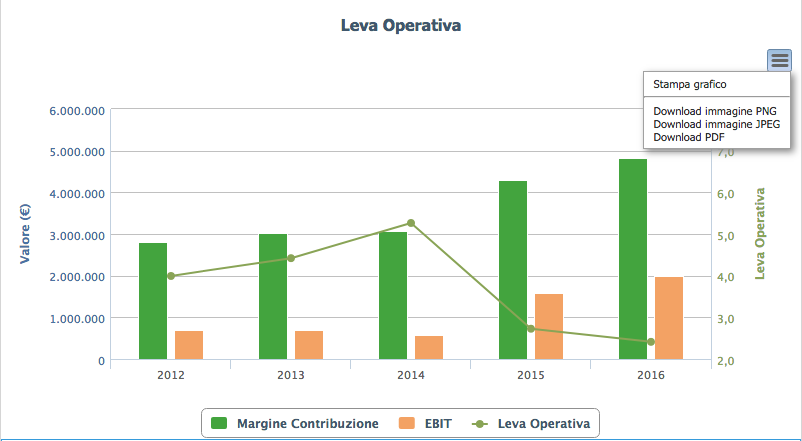

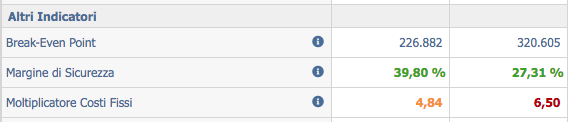

Break-Even, Safety Margin, Financial Leverage, Fixed Cost Multiplier

Leanus automatically processes all the main financial indicators for each company or group and for each year, including the Break Even, the Safety Margin, the Operating Leverage, the Financial Leverage and the Fixed Cost Multiplier

What is Break-Even?

Break-even is the value of revenues which, for a given cost structure, makes theEBIT equal to zero

How is the Break-Even calculated?

The image shows an example in which, in the face of Euro 1.000.000 in revenues, the Contribution margin (Revenues - Consumption - Variable Costs) is equal to Euro 500.000 (or 50% of Revenues). This means that for every 1.000.000 of Revenues the company incurs costs directly related to Revenues equal to 50%.

Therefore the Contribution margin it is what remains available to the company to cover fixed costs, depreciation, taxes, etc. In the example, this value is equal to Euro 400.000 (Fixed costs equal to 300.000 + Depreciation equal to 100.000 = 400.000)

It follows that theEBIT is equal to Euro 100.000

The Break-Even Value will certainly be lower (in the example equal to Euro 800.000).

To calculate it it must be taken into account that every Euro 100.000 of additional revenues, Euro 50.000 (equal to the Contribution Margin) will cover the costs directly related to the revenues (Consumption - Variable Costs); Euro 50.000 will be used to cover fixed costs or, at the same fixed costs, will increase the profit.

Vice versa, for each reduction of Euro 100.000 in Revenues, Consumption and Variable Costs they will be reduced by Euro 50.000, therefore theEBIT it will be reduced by the residual part, ie by Euro 50.000.

In the example in 2016,EBIT is equal to 100.000. To calculate the Break-even, it is necessary to calculate how much the Revenues must be reduced to obtain a EBIT equal to Zero, that is to divide the value ofEBIT (100.000) for the Contribution Margin (0,5) and obtain 200.000; the break-even value will therefore be equal to 1.000.000 - 200.000 = 800.000.

The column corresponding to 2017 shows the economic profile obtained by assuming the Revenues equal to the Break-Even. It can be noted that the incidence of Consumption, Variable Costs and Contribution Margin is identical - as a percentage - to that of 2016

If the value of the Contribution Margin is less than or equal to zero, how is the Break-Even calculated?

In this case, with the same direct cost structure, the firm cannot reach the Break-Even

Does the Break-Even therefore depend on the reclassification of costs between fixed and variable?

SI.

The greater the contribution margin, the better the economic impact deriving from an increase in revenues; the Contribution Margin can be influenced by the reclassification model

What is the Safety Margin?

Indicates as a percentage how much the Break-Even differs from the Revenues for the year. In the example 1- 800.000 / 1.000.000 = 20%

What is the operating leverage?

The Operating Leverage is given by the ratio between the Contribution Margin and theEBIT and allows you to evaluate the distribution of costs between fixed and variable.

The higher the Operating Leverage, the greater the economic benefit deriving from an increase in Revenues.

What is the Fixed Cost Multiplier?

The Fixed Cost Multiplier + the ratio between 1 and the Contribution Margin in relation to Revenues.

A Multiplier equal to 4 indicates that for each Euro of additional Fixed Costs an increase in Revenues equal to 4 Units is necessary, with the same cost structure.

For example, if, with a Fixed Cost Multiplier equal to 4, an increase in financial charges of € 1.000.000 for 5 years is assumed, to maintain the same Break-Even it will be necessary to generate additional revenues of € 4.000.000.

In which menus is it possible to view the Fixed Cost Multiplier?

The indicator is shown both in the indices (of Historical Analysis, Benchmark and Business Plan) and in Home in the "Last Period Valuation" box.

Which menus are the indicators in?

Both historical data and on the data of the Benchmark and the Business Plan, the break-even is visible at the bottom of the table; the graphical analyzes are present under the Summary of the Balance Sheet Analysis Menu, and under the graphical analysis of the Profit and Loss Account of Benchmark and Business Plan. Break-Even and Fixed cost multiplier are also present in the Boxes present in the Home Menu

What is financial leverage?

It is the ratio between the Financial Debts (reclassified between the Sources) and the Net Equity (or Equity); indicates the distribution of the Sources (excluding liquidity) between Debts contracted with the System (external resources) and Equity (internal resources)

To view graphical analyzes

Log in to Leanus

Search or Process company analysis of your interest

Verifica that the * Leanus reclassification schemes are those desired

Go to * Menu: Balance Sheet Analysis »Summary .. or to the corresponding Benchmark and Business Plan menus to view the desired analyzes

It is possible to search for any index or indicator through the search box "What are you looking for?" present on all pages of the software.

Post your feedback on this topic.